Not known Details About Best Refinance Offers

Wiki Article

The Definitive Guide to Best Home Loan Refinance Offers

Table of ContentsA Biased View of Refinance DealsThings about Best Refinance DealsLittle Known Questions About Best Refinance Offers.The Mortgage Refinance Deal Statements

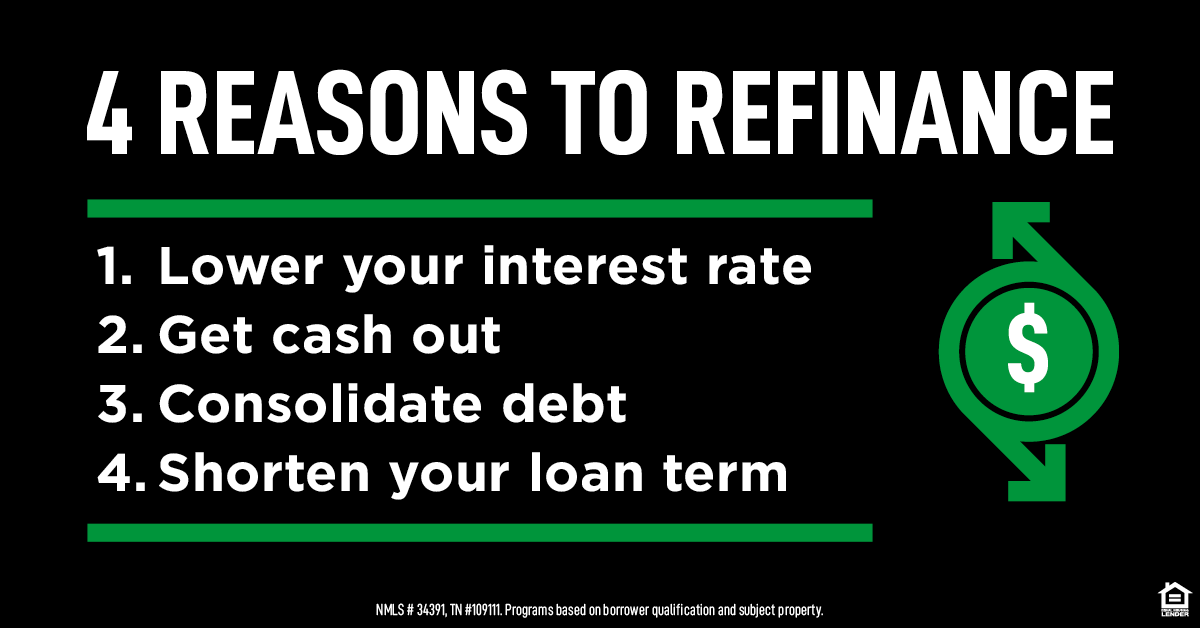

As a debtor, you can possibly save thousands of dollars over the term of your finance when you secure a reduced passion price (refinance deals). And in a lot of cases, a reduced rate of interest also implies a lower monthly home loan settlement. This passion savings might permit you to pay off other high-interest financial obligation, include in your savings account or put even more bucks toward retirement:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Re-financing your mortgage may feel like an overwhelming possibility, but doing so could conserve you thousands on your home loan. Like anything, it does not come without its risks, so have a look at our benefits and drawbacks listing to see if it might function for you. One of the greatest benefits of refinancing is to make use of a lower rates of interest.

You can use this cash on important or non-essential items, or proceed to pay at the degree of your previous settlements and repay your lending quicker, conserving you on rate of interest. Re-financing your mortgage means you may have the alternative to lower the length of the car loan. Bear in mind this will probably increase your monthly repayments, but if you're in a placement to do so, paying your funding off quicker is likely to conserve you on interest over the life of the finance.

Some Ideas on Mortgage Refinance Deal You Need To Know

Your month-to-month repayments will certainly enhance however you will likely save thousands on interest. See to it you do the math to see just how much you would save money on rate of interest to ensure this technique works for you. Home equity describes the difference in what you've settled on your loan and the value of your home.When you re-finance your home your lending institution may allow you to access some or every one of this equity, which you can utilize however you want. It's widespread for consumers to access their equity and utilize it for things like renovations, vacations, a cars and truck, or investing. Bear in mind your equity is a powerful tool in working out with your loan provider, and can assist you to gain accessibility to a much better rates of interest.

A redraw center permits you to make additional payments on your financing and redraw these if needed, at the discernment of the lending institution. A balanced out account is a wonderful means to decrease interest on the funding, while a redraw center can be beneficial in an emergency situation or if you require to make a large acquisition.

The Ultimate Guide To Best Refinance Deals

If you're currently on a variable price car loan refinancing suggests you might have the ability to switch to a fixed price, and the other way around. With rate of interest at record low for several years, you might make a decision fixing your loan is the means to visit offer you capital assurance. Or, you might think passion prices may go lower, so you desire to switch to a variable rate and have some adaptability.In the existing setting, no homeowner can manage to just assume their car loan offers great worth. If you've had your funding for a few years, possibilities are, there can be range for you to save. By protecting a more affordable rate of interest and reducing your regular monthly settlement, you could be qualified to more savings than you become aware.

It deserves knowing it doesn't need to take 25 or thirty years to repay a home. Here are some top pointers you'll wish to read that might simply aid you Refinancing is frequently used to maximize the equity you have in your current home in order to money purchases or way of living goals.

Just how much equity you can use will range lenders, which is why having a mortgage professional on your side could make all the distinction when it involves doing the research. Learn even more regarding accessing your home's equity..

Some Of Mortgage Refinance Deal

Australian passion prices are on the rise. Lots of previously comfy house owners may be really feeling the pinch as loan providers pass through that money price in the type of greater interest rates.:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

With interest rates growing, there's never ever been a better time for Australians to make the button to a home loan with a better rate of interest, or make the relocate to a new provider with fewer fees. You can refinance your home financing with your current bank, a brand-new lending institution, and even a home loan broker.

A lower rates of interest might conserve you thousands of dollars over the lifetime of the finance. Changing to a home lending with a lower rate of interest can additionally possibly aid you repay your mortgage earlier. If you obtain a far better rates of interest and proceed to make the same repayments as you did on your old funding, you'll shorten the term of your funding.

Report this wiki page